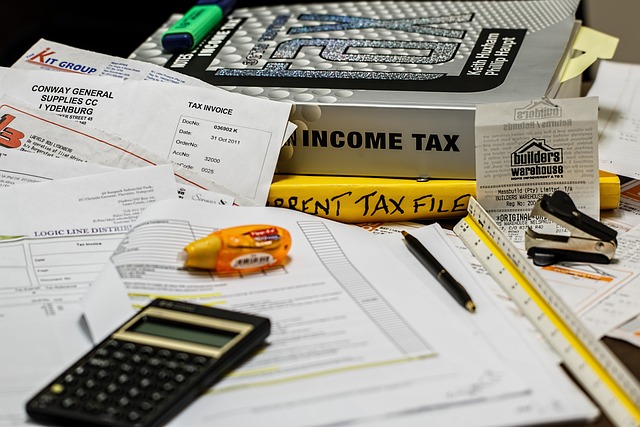

Taxation

Comprehensive Tax Planning, Compliance, and Advocacy

Taxation

Contact Our ExpertsOverview

Navigating tax complexities requires a partner with both technical expertise and a strategic approach. Ratgeber’s Taxation services cover everything from tax planning and filing to litigation support. We help businesses mitigate tax risks, leverage tax incentives, and stay compliant, ensuring financial operations remain optimized.

Featured Case Studies

Strategic Tax Planning and Optimization

We create tailored tax strategies that maximize deductions, credits, and exemptions, improving the financial health of your business.

Corporate and Personal Tax Filing

Ratgeber handles all aspects of tax filing for corporations and individuals, ensuring accuracy and compliance with local and international tax codes.

Litigation Support and Dispute Resolution

Our tax experts assist clients with audit defense, appeals, and tax dispute resolution, providing essential advocacy and representation when needed.

Compliance and Regulatory Updates

We proactively monitor tax legislation changes, offering timely guidance and adjustments to keep clients compliant and ahead of regulatory shifts.

Our Insight

Effective tax management goes beyond compliance; it can be a strategic tool for financial optimization. With frequent regulatory changes, businesses need a partner who anticipates shifts and adapts strategies accordingly. Our approach emphasizes proactive tax planning, helping clients leverage credits, deductions, and incentives available within local and international frameworks. We conduct detailed tax scenario analyses, enabling businesses to make informed decisions on tax structures and minimize liabilities. Moreover, our litigation support and dispute resolution expertise ensure clients are prepared to handle audits and inquiries effectively, giving them a secure foundation for growth and stability.

Related Links

Our Experts

Our Taxation experts are proficient in all aspects of tax strategy, compliance, and litigation support. With years of experience managing tax, VAT, and customs for multiple sectors, they possess a comprehensive understanding of complex tax regulations. Their skills in tax planning, compliance monitoring, and dispute resolution help clients optimize their tax obligations, minimize liabilities, and navigate changing tax landscapes with confidence.